By Marshall Breeding, Director for Innovative Technology and Research, Vanderbilt University, Nashville

In this article:

Author’s Note: I’ve had the privilege of writing the Automation Marketplace for a decade. During this time, the industry has seen profound changes in the companies involved, products offered, and prevailing technologies. A decade ago, the industry was working its way through the transition into client/server computing. Today we see a new cycle beginning that brings libraries into alignment with the shift to cloud computing and the increasing dominance of electronic and digital content relative to library collections and services. This year’s Automation Marketplace reflects on the progress and transitions of the last decade as it examines the current key accomplishments of the industry.

As development efforts near completion on a new slate of automation products, vendors are beginning to pull out all the stops to monetize them. A new round of competition is heating up to place these new products in libraries, replacing their own legacy products and aiming to displace those of other companies. Ex Libris’s Alma, OCLC’s WorldShare Management Services, Innovative Interfaces’ Sierra, and Serials Solutions’ Intota, as well as the open source Kuali OLE project, are positioned to move toward more dominant market share through a product cycle that will play out over the next decade. These new-generation products will compete with well-established proprietary and open source systems following an evolutionary path, such as Evergreen, Koha, Polaris ILS, The Library Corporation’s (TLC) Library.Solution, SirsiDynix’s Symphony, and Auto-Graphics’ AGent VERSO.

The transition to new-generation products is a delicate business. Libraries don’t respond well to enforced, abrupt transitions. But savvy and well-resourced vendors divide their energies between developing, maintaining, and supporting their existing products, even as they channel the bulk of their energies to developing and marketing new ones. Failings with legacy products can result in lost credibility, which can take a large toll on the prospects of new offerings. [Ed. note: A more detailed version of this decade-long overview, with information about the K–12 and international markets and more in-depth charts, can be found online at thedigitalshift.com/?p=7053.]

As issues regarding ebook lending roil libraries, publishers, and service providers such as OverDrive, automation vendors are working to integrate ebook management and access effectively into their management platforms and discovery services.

Mobile and social networking themes are driving other threads of development. The ever-increasing use of smartphones, tablets, and other mobile devices are making it necessary for libraries to expand access to their collections and services to these users. Most vendors now offer some type of mobile product, and business models include free options that increase the value of their broader offerings to add-cost products. The pervasive influence of social networking sets expectations for all patron-facing products and presents opportunities for products that directly engage these media, such as SirsiDynix’s Social Library, a native Facebook app that enables catalog search and patron services.

The state of the industry

In 2011, the library automation economy—the total revenues (including international) of all companies with a significant presence in the United States and Canada—was $750 million. This estimate does not necessarily compare directly to 2010’s $630 million, as this year’s estimate includes a higher proportion of revenues from OCLC, EBSCO, and other sources previously unidentified. (Using the same formula, 2010 industry revenues would be estimated at $715 million.)

As OCLC becomes ever more involved as competition in the library automation industry, we have performed a more detailed analysis of what proportion of its revenues derive from products and services comparable to other companies considered in this report. Of OCLC’s FY11 revenue of $205.6 million, we calculate that $57.7 million falls within that scope.

A broader view of the global library automation industry that aggregates revenues of all companies offering library automation products and services across the globe totals $1.76 billion, including those involved with radio-frequency identification (RFID), automated handling equipment, and self-check, or $1.45 billion excluding them. Library automation revenues limited to the United States total around $450 million.

The overall library economy continues to suffer major cutbacks that may never be fully restored, so library automation vendors are facing enormous challenges to find growth opportunities. Libraries may only be able to justify investments for tools that enable them to operate with fewer resources. Software-as-a-service (SaaS) deployments, for example, result in revenue gains through subscription fees commensurate with delivering a more complete package of services, including hosting; libraries see overall savings as they eliminate local servers and their associated costs. Stronger companies can increase their slice by taking on competitors with weaker products, especially those in international regions.

The ongoing trend of open source integrated library systems (ILSs) cannot be discounted. Open source ILS implementations shift revenues from one set of companies to another, often at lower contract values relative to proprietary software. Scenarios vary, so it’s difficult to determine whether these implementations result in true savings in total ownership costs and to what extent costs shift back to the libraries or their consortial or regional support offices.

Three-Year Sales Trends by Category

Numbers represented here are as reported by the vendors; blank spaces indicate that no data was provided, or companies gave only aggregate figures.For expanded data from this table and more, see The Complete Survey Data

| Company | System Name | 2009 Total | 2010 Total | 2011 Total | 2011 New |

|---|---|---|---|---|---|

Library Services Platforms | |||||

| Ex Libris | Alma | 8 | 24 | 0 | |

| Innovative Interfaces, Inc. | Sierra | 206 | 1 | ||

| OCLC | WorldShare Management Service | 184 | |||

| Serials Solutions | 0 | 0 | |||

ILSes for Public, Academic & Consortia | |||||

| Company | System Name | 2009 Total | 2010 Total | 2011 Total | 2011 New |

| SirsiDynix | Symphony | 126 | 122 | 41 | |

| SirsiDynix | Horizon | 20 | 2 | 2 | |

| Innovative Interfaces, Inc. | Millennium | 45 | 39 | 32 | 32 |

| The Library Corporation | Library.Solution | 30 | 43 | 48 | 48 |

| The Library Corporation | Carl.X / Carl.Solution | 0 | 3 | 2 | 0 |

| InfoVision Technology | Evolve | 73 | 19 | 9 | |

| OCLC | Amlib LMS | 5 | 12 | 0 | 0 |

| Ex Libris | Voyager | 2 | 5 | 1 | 1 |

| Ex Libris | Aleph | 47 | 39 | 25 | 18 |

| VTLS Inc. | Virtua | 18 | 22 | 13 | 12 |

| Polaris Library Systems | Polaris ILS | 33 | 23 | 53 | 53 |

| Civica | Spydus 8 / MS | 15 | 32 | 46 | 15 |

| Infor | Vubis Smart | 12 | 1 | 0 | 0 |

| Infor | V-smart | 12 | 21 | 30 | |

| ISACSOFT | PortFolio | ||||

| ISACSOFT | Concerto | ||||

| ByWater Solutions | Koha | 7 | 44 | 54 | 48 |

| PTFS Liblime | Koha | 40 | 22 | 22 | |

| Equinox Software | Evergreen | 18 | 15 | 21 | 20 |

| Talis | Talis Alto | 2 | 0 | 1 | 1 |

| Biblionix | Apollo | 55 | 87 | 79 | 79 |

| Auto-Graphics, Inc. | AGent VERSO | 18 | 13 | 16 | 12 |

| Keystone Systems, Inc. | KLAS | 4 | 0 | 0 | 0 |

Business cycles

The first sentence of LJ’s 2002 Automation Marketplace remarkably still reflects the state of the industry today:

A smaller group of larger firms dominate the library automation marketplace. They are largely international, diversified, and privately owned. The mergers and consolidations that marked the recent history of the industry have absorbed the weaker products and companies.

The consolidation of that era, funded mostly by venture capital or individual investors, led to much more aggressive changes that have played out since.

But the library automation industry of 2002 was also strikingly different from that of today. Among the major companies, Innovative Interfaces stood as the largest company in terms of revenue, personnel, and customers. In the big news of that year, Sirsi had acquired DRA. Epixtech, soon to be renamed Dynix, had previously acquired NOTIS and earlier had taken over a set of automation products cast off by OCLC. Endeavor Information Systems was operating under the ownership of publishing giant Elsevier Science. Gaylord Information Systems operated as a subsidiary of Gaylord Bros. Geac was beginning to see its North American market share erode,, though its position in Europe was strengthening. In the K-12 school library arena, Sagebrush had become a major player through the acquisition of Winnebago Spectrum and Athena and had worked out a partnership with Sirsi to offer a centralized system called Accent based on Unicorn technology. Bibliomondo was formed through the merger of ALS International and Best Seller.

Largely fueled by private equity, the last decade has seen a series of business transactions that have concentrated much of the industry’s economy into the hands of a small number of companies. Golden Gate Capital acquired Geac and folded it into Infor, where its library division continues with a focus on European libraries. Vista Equity Partners assembled SirsiDynix from the already consolidated Sirsi and Dynix, executing a strategy of business integration that has resulted in a streamlined company that manages a very large customer base with a lean workforce. Francisco Partners bought Ex Libris and Endeavor in separate transactions, forming a new company (Ex Libris Group) with a research and development focus that has driven the creation of new products that have attracted a growing customer base. Leeds Equity acquired ownership in 2009, largely continuing existing business strategies.

Family owned Follett Software Company acquired competitor Sagebrush, including its acquired ILS products Winnebago Spectrum, InfoCentre, and Athena. Once in widespread use, each of these has been dying a slow death, starved from development and used by libraries hard-pressed to find resources to replace them. Nonprofit OCLC made a series of business acquisitions, including PICA, Fretwell-Downing, Sisis Informationssysteme, InfoVision Technologies, BOND GmbH, Openly Informatics, Useful Utilities (EZ Proxy), and DiMeMa (CONTENTdm). Along with these large consolidated entities, many mid-sized and small companies thrive.

The business cycles that have shaped the industry to this point will likely continue. At some point, current private equity owners will cash out their investments. These new transactions might simply involve new ownership, but the possibility of additional consolidation cannot be ruled out.

Large companies dominate

Ex Libris now ranks as the largest company in terms of personnel, 512 overall, with 170 allocated to development, nearly twice that of any competitor. Based on revenue estimates, SirsiDynix, Ex Libris, and Innovative Interfaces, respectively, rank largest in the industry.

In terms of ILS installations supported in the academic and public library sector, SirsiDynix leads with 3,688 (Symphony: 2,377, Horizon: 1,311), followed by Ex Libris with 3,571 (Aleph: 2,316, Voyager: 1,255), then Innovative Interfaces (1,425).

As a whole, OCLC looms larger than any of the other firms in the library automation industry by personnel employed, libraries served, and revenues. But when considering only the specific areas of involvement with the scope of the library automation industry, OCLC ranks about fifth.

Ample opportunity

While large companies dominate, many smaller enterprises thrive by exploiting niches that larger firms may not consider worthwhile and cultivating new library customers by providing high-quality personalized services.

Start-ups are not common in the library automation industry, though some recently formed companies show great potential for growth. ByWater Solutions entered the scene most recently, in April 2009, and has seen dramatic growth in the number of libraries contracting for its services to support the open source Koha ILS. In its first three years, it garnered seven, 44, and 54 support contracts, respectively, serving a total of 446 libraries. Biblionix began offering its hosted Apollo ILS in 2006, with active marketing beginning in 2008, with 49, 55, 87, and 79 respective sales in subsequent years, and a current customer base of 272 libraries. Its focus on automating small public libraries with a fully hosted web-based ILS has proven to be a successful strategy.

The library automation industry includes a number of midsized companies with very long histories. Some of these have remained relatively flat, or have even downsized over time, but continue to operate profitably. Such companies include Auto-Graphics, with its 45 personnel in 2002, down to 34 today; Book Systems (88 to 60); and EOS International (69 to 52). Others have seen growth, such as TLC (173 in 2002, up to 199 in 2011), VTLS (100 to 110), and Keystone Systems (12 to 17).

2011 Personnel Trends

Numbers represented here are as reported by the vendors; blank spaces indicate that no data was provided, or companies gave only aggregate figures.For expanded data from this table and more, see The Complete Survey Data

| Company | Development (2011) | Support (2011) | Sales (2011) | Admin (2011) | Other (2011) | Total (2011) | + / - from 2012 | Librarians on Staff |

|---|---|---|---|---|---|---|---|---|

| Auto-Graphics, Inc. | 7 | 8 | 8 | 3 | 8 | 34 | 2 | 6 |

| Axiell | 57 | 66 | 34 | 35 | 34 | 226 | 3 | 42 |

| Book Systems, Inc. | 15 | 21 | 18 | 4 | 2 | 60 | 0 | 4 |

| ByWater Solutions | 3 | 12 | 3 | 3 | 1 | 13 | 7 | 6 |

| Civica | 19 | 371 | 14 | 6 | 410 | 10 | 21 | |

| COMPanion Corp. | ||||||||

| Cuadra | 7 | 4 | 2 | 3 | 2 | 18 | 0 | 4 |

| CyberTools, Inc. | ||||||||

| EOS International | 11 | 14 | 20 | 4 | 3 | 52 | 0 | 2 |

| Equinox Software | 6 | 5 | 2 | 3 | 5 | 21 | -1 | 11 |

| Ex Libris | 170 | 231 | 54 | 44 | 13 | 512 | 8 | |

| Follett Software Company | 87 | 143 | 86 | 49 | 0 | 365 | -43 | |

| Infor Library Solutions | 16 | 36 | 13 | 6 | 71 | 0 | ||

| InfoVision Technology | 5 | 3 | 3 | 0 | 13 | 3 | 0 | |

| Inmagic, Inc. | ||||||||

| Innovative Interfaces, Inc. | 83 | 158 | 43 | 24 | 3 | 311 | 4 | 118 |

| L4U Library Software | ||||||||

| Keystone Systems, Inc. | 5 | 6 | 3 | 2 | 1 | 17 | 0 | 3 |

| LibLime | ||||||||

| LibraryWorld, Inc | ||||||||

| The Library Corporation | 39 | 91 | 28 | 13 | 28 | 199 | 0 | 25 |

| Mandarin Library Automation | ||||||||

| OCLC | 1211 | 11 | ||||||

| Polaris Library Systems | 27 | 42 | 15 | 2 | 86 | 8 | 29 | |

| PTFS | 5 | 16 | 8 | 8 | 155 | 0 | 14 | |

| Sagebrush Corporation | ||||||||

| Serials Solutions | 80 | 50 | 46 | 4 | 57 | 237 | 29 | 60 |

| SirsiDynix Corporation | 84 | 166 | 51 | 23 | 56 | 380 | -5 | |

| Softlink International | ||||||||

| Surpass Software | ||||||||

| SydneyPLUS | ||||||||

| Capita (formerly Talis) | 43 | |||||||

| VTLS Inc. | 24 | 48 | 12 | 8 | 18 | 110 | 14 | 17 |

Business transitions

Relatively few mergers or acquisitions transpired in 2011. UK-based Talis, a company that had divided its business activities between traditional library automation products and services and semantic web technologies, split itself along those lines; Capita, a large outsourcing services firm acquired the library automation side, including its Alto library management system and related products. Talis will continue to exploit its semantic web services but largely outside the library arena.

SydneyPLUS, a company involved primarily with special libraries, acquired the brand and library automation assets of competitor Inmagic, but Inmagic will continue to operate as an independent wholly owned subsidiary.

OCLC continued its buying spree of European library automation companies with the acquisition of BOND, which supplies the Bibliotheca2000 and Bibliotheca.Net library management system to around 4000 libraries in Germany, Austria, and Switzerland. According to the 2011 OCLC Annual Report, this transaction was valued at $5.9 million. This acquisition is but the latest in a series that brings large numbers of libraries operating legacy ILS products under OCLC’s aegis. We can speculate that one thread of interest involves providing these libraries with an attractive migration path into OCLC’s WorldShare Management Services.

In the RFID, self-service, and automated handling arena, a major consolidation took place through the acquisition of Switzerland-based Bibliotheca RFID Systems, UK-based Intellident, and Integrated Technology Group in the United States by the private equity firm One Equity Partners to form a new global firm. In February 2012, Bibliotheca Group also acquired the Swiss company Trion AG, which designs and manufactures automated materials handling equipment for libraries.

Library services platforms gain momentum

One of the major vectors of the industry involves the emergence of a new genre of automation products poised to begin a new cycle of migrations. These products differ substantially from ILSs and cannot be considered as within the same product category. We term these new offerings library services platforms. Salient characteristics include management of print and electronic library materials, reliance on global knowledgebases instead of localized databases, deployment through multitenant SaaS based on a service-oriented architecture, and the provision of a suite of application programming interfaces (APIs) that enable greater interoperability and extensibility. There are significant differences within the product category, however, with quite distinct conceptual, functional, and technical characteristics. Implementation of a library services platform can potentially displace multiple existing products, including ILSs, electronic resource management tools, OpenURL link resolvers, and digital asset management systems.

OCLC was first out of the blocks in this genre. For 2010, we reported five production deployments of what was then called Web-scale Management Services. The product has since been rebranded as WorldShare Management Services (WMS), and OCLC has continued to develop the underlying infrastructure and articulate its vision. The WorldShare Platform provides the general infrastructure that underlies WMS, and it can also serve as the basis for applications created by OCLC members or third parties. OCLC intends to cultivate an active community of library programmers engaged with creating services based on the WorldShare Platform. OCLC has expanded the number of data centers supporting the WorldShare Platform to provide a more global infrastructure, growing from the original two in the United States, with one in the UK in 2011, with plans for more in continental Europe, Canada, and Australia in 2012.

By the end of 2011, 38 libraries were in production with WMS and another 184 had committed to implement. WMS broke into the realm of the large academics with the University of Delaware committing to implement by 2013. In early 2012, OCLC announced the WorldShare License Manager to offer full functionality for managing electronic resources.

Ex Libris continues to work toward the completion and release of Alma, its new library services platform, implementing its principles of unified resource management. Development has been under way since 2009 with the engagement of development partners Boston College; Princeton University, NJ; Katholieke Universiteit Leuven, Flanders, Belgium; and Purdue University, West Lafayette, IN. Through 2011, the institutions worked with Ex Libris to provide input into the design, testing, and evaluation of a series of Alma Partner Releases, culminating with a final version delivered toward the end of the year. General release of Alma is expected in early to mid-2012. Beyond the initial set of development partners, Ex Libris has signed 24 contracts for 55 institutions to become early adopters of Alma.

In April 2011, Innovative Interfaces announced that it would develop a new generation automation platform called the Sierra Services Platform. Taking forward the functionality of its Millennium ILS, Sierra embraces a new technical architecture, a more open design exposing a service layer of APIs for multiple functions, and a new suite of applications. Unlike Millennium, which offers separate modules for each functional area, Sierra follows a more unified approach, delivering all staff tasks through a single client. Sierra will make use of open source components such as PostgreSQL, for data storage and transactions, and Apache Lucene, for search and retrieval. Millennium had gained a reputation as a relatively closed system—a vulnerability at a time when many libraries strategically want more access to data and functionality. Innovative Interfaces began initial testing of Sierra late in 2011 and plans to deliver an initial production version this year.

In June 2011, Serials Solutions announced that it was jumping into the library automation arena with a web-scale management solution, since named Intota. It would extend the approach that Serials Solutions has taken with the management of electronic resources to print materials, including reliance on a knowledgebase collectively shared by libraries that use the product, management of individual library holdings through profiles, and deployment through multitenant SaaS. Serials Solutions will release Intota in multiple phases, beginning in late 2012, with a more complete product available by the end of 2013.

Sales leaders

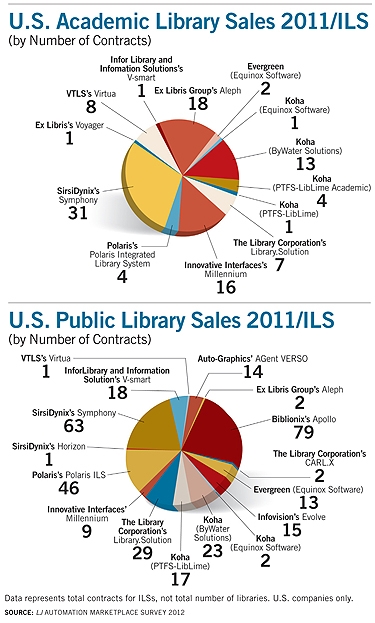

Sales leaders

There was a 2011 uptick in contracts for major library automation products. Innovative Interfaces led the industry with an impressive 206 contracts signed as early adopters of Sierra, representing 700 libraries and 1,616 facilities. The company inked an additional 32 contracts for Millennium, totaling 238 contracts overall in 2011, an unprecedented number for at least the last decade in the public and academic sectors.

In this saturated market, where few libraries are automating for the first time, winning contracts with new clients is essential to grow a company’s customer base. In 2011, Polaris led in new-name sales, more than doubling its 2010 total with 53 contracts, followed by TLC with 48 contracts for Library.Solution (down from 43). Forty-one of the 122 contracts (covering 725 libraries) that SirsiDynix signed for Symphony were to libraries not previously using its products. And OCLC reported 184 contracts for WMS in 2011.

In the open source arena both ByWater Solutions and Equinox Software saw substantial gains. LibLime-PTFS saw a decline in new contracts from 40 in 2010 to 22 in 2011.

Not surprisingly, companies offering new library services platforms saw declines in their traditional ILS products: Ex Libris reported 25 Aleph contracts in 2011, down from 39 in 2010; Innovative Interfaces made 39 sales of Millennium in 2010 but only 32 in 2011, though all were to new-name customers.

As the library automation industry becomes increasingly globalized, many companies based in the United States have significant international involvement. Innovative Interfaces gets 30 percent of its revenue from outside the United States. Just under half of the contracts SirsiDynix signed in 2011 were to international libraries, and OCLC is active in many regions of the globe, with 25 percent of revenues earned outside the United States. Ex Libris, based in Israel, earns about one-third of its revenue in the United States. Civica currently has only a handful of sites in the United States or Canada, but it is a dominant player in the UK, Australia, and Asia with its Spydus LMS and other products. Infor Library and Information Solutions, a small division within a very large IT services firm, stands as a significant player in the European library automation market, with a small presence in the United States and Canada with its Vubis Smart and V-smart library management system and Iguana library portal. Axiell Group ranks as one of the largest companies in the industry worldwide and is dominant in Scandinavia; it also has a smaller portion of the UK market, but has not brought its products to North America.

Many other companies prosper in specialized markets, defined geographically or linguistically. Mondo In, formerly BiblioMondo, operates mostly in French-speaking regions; Baratz overwhelmingly dominates among public libraries in Spain and is a strong competitor in neighboring Portugal and France. The company also has a significant presence in Latin America. While we do not cover all of these companies in detail, in a globalized library automation economy it’s important to consider that important innovations can emerge from companies with little or no presence in the United States.

2011 Sales by Category

Numbers represented here are as reported by the vendors; blank spaces indicate that no data was provided, or companies gave only aggregate figures.For expanded data from this table and more, see The Complete Survey Data

| Company | System Name | New Name Customers | Existing Customers | Total Contracts | Installed |

|---|---|---|---|---|---|

Library Services Platforms | |||||

| Ex Libris Group | Alma | 2 | 24 | 24 | 55 |

| Serials Solutions | Intota | 0 | 0 | ||

| Innovative Interfaces, Inc. | Sierra Services Platform | 1 | 205 | 206 | 0 |

| OCLC | WorldShare Management Services | 184 | 38 | ||

Discovery Products and Services | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| EBSCO Publishing | EBSCO Discovery Service | ||||

| Ex Libris Group | Primo | 14 | 90 | 111 | 914 |

| Serials Solutions | Summon | 214 | 21 | 407 | |

| Serials Solutions | AquaBrowser | 214 | 154 | 250 | |

| Innovative Interfaces, Inc. | Encore | 72 | 326 | ||

| OCLC | WorldCat Local | 1578 | |||

| Civica Pty Limited | Sorcer | 22 | 22 | 39 | |

| Axiell Group AB | Axiell Arena | 78 | 55 | 33 | 76 |

| SirsiDynix | SirsiDynix Enterprise | 12 | 100 | 251 | |

| SirsiDynix | SirsiDynix Social Library | 0 | 37 | 37 | |

| The Library Corporation | LS2 Kids | 43 | 88 | ||

| The Library Corporation | LS2 PAC | 88 | 236 | ||

| BiblioCommons | BiblioCore | ||||

| Capita | Prism | 0 | 0 | 0 | 89 |

| Mandarin Library Automation, Inc. | M3 Web OPAC | 42 | 42 | ||

| VTLS Inc. | Chamo | 7 | 1 | 7 | 51 |

| VTLS Inc. | ChaVis | 3 | |||

| VTLS Inc. | Visualizer | 1 | 1 | 3 | |

| VTLS Inc. | Vitation | 2 | |||

Federated Search | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| Ex Libris Group | MetaLib | 15 | 28 | 43 | 1746 |

| Serials Solutions | 360 Search | 58 | 330 | ||

| Serials Solutions | WebFeat | 0 | 40 | ||

| Innovative Interfaces, Inc. | Research Pro | 2 | 314 | ||

| Auto-Graphics, Inc. | AGent Portal | 2 | 2 | 2 | 1307 |

| Auto-Graphics, Inc. | AGent Search | 2 | 2 | 2 | 1307 |

| Book Systems, Inc. | Surfit | 24 | 0 | 26 | 443 |

| EBSCO Publishing | EBSCOhost Integrated Search | ||||

| Infor Library and Information Solutions | V-spaces | ||||

| OCLC | ZPORTAL | ||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

Mobile Products | |||||

| The Library Corporation | LS2 Mobile | 27 | 33 | ||

| SirsiDynix | BookMyne | 530 | |||

| SirsiDynix | BookMyne+ | ||||

Digital Library Management System | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| SirsiDynix | SirsiDynix Portfolio | 8 | 44 | 55 | |

| Auto-Graphics, Inc. | AGent Digital Collections | 2 | |||

| Ex Libris Group | DigiTool | 4 | 1 | 7 | 193 |

| Ex Libris Group | Ex Libris Rosetta | 1 | 0 | 5 | 15 |

| OCLC | CONTENTdm | 924 | |||

| Civica Pty Limited | Blis | 13 | 13 | 14 | |

| PTFS | ArchivalWare | ||||

| VTLS Inc. | VITAL Media | 1 | |||

Electronic Resource Management Support | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| Innovative Interfaces, Inc. | Electronic Resource Management | 18 | 332 | ||

| Ex Libris Group | Verde | 2 | 7 | 8 | 229 |

| Serials Solutions | 360 Core | 76 | 456 | 621 | |

| Serials Solutions | 360 Counter | 66 | 102 | 256 | |

| Serials Solutions | 360 MARC Updates | 53 | 310 | 444 | |

| Serials Solutions | 360 Resource Manager | 33 | 145 | 273 | |

| Serials Solutions | Ulrichs Serials Analysis System | 21 | 106 | 167 | |

| Serials Solutions | Ulrichsweb | 53 | 809 | 979 | |

| Infor Library and Information Solutions | V-sources | ||||

Institutional Repository | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| Civica Pty Limited | Exhibit | 1 | 1 | 4 | |

| VTLS Inc. | VITAL | 1 | 1 | 31 | |

OpenURL Linking Application | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| Ex Libris Group | SFX | 66 | 93 | 119 | 2306 |

| Serials Solutions | 360 Link | 224 | 593 | 974 | |

| EBSCO Publishing | LinkSource | ||||

| Infor Library and Information Solutions | V-link | ||||

| Innovative Interfaces, Inc. | WebBridge LR | 9 | 385 | ||

| OCLC | WorldCat Link Manager | ||||

Resource Sharing systems | |||||

| Company | System Name | New Name | Existing | Total Contracts | Installed |

| Auto-Graphics, Inc. | AGent Resource Sharing | 2703 | |||

| OCLC | VDX | ||||

| OCLC | WorldCat Navigator | ||||

RFID Support | |||||

| VTLS Inc. | FASTRAC (RFID) | 1 | 1 | 18 | |

| Civica Pty Limited | Spydus 8 RFID | 10 | 12 | 23 | |

Archives Management | |||||

| Axiell Group AB | Axiell Calm | 0 | 0 | 22 | 423 |

| VTLS Inc. | Virtua for Archives | 2 |

Technology cycles

A decade ago, the library automation industry was in the throes of a transition from ILSs based on host-terminal hardware and text-based interfaces to new products based on then-in-vogue client/server architecture. Mainframes had become prohibitively expensive to operate. Powerful personal computers with graphical interfaces and faster networks ushered in this new era in computing. A wave of development beginning in the early to late 1990s launched client/server ILSs, including Dynix’s (now SirsiDynix’s) Horizon, Endeavor’s (now Ex Libris’s) Voyager, VTLS’s Virtua, and the Polaris ILS. Sirsi’s Unicorn ILS evolved from the host-terminal era through the introduction of new clients, initially InfoVIEW and later WorkFlows. Innovative Interfaces took a similar evolutionary route by developing a new set of Millennium modules to operate with the same server software as INNOPAC.

Now, prevailing trends in technology favor products that embrace service-oriented architectures and web-based interfaces, designed to be deployed though cloud technologies, though some concerns persist regarding security and reliability.

That said, the trend away from local library hosting isn’t new. In 2002, we observed that more companies offer an ASP (Application Service Provider) model.

That model of vendor hosting of client/server products persists today, often labeled as managed services or SaaS. In its infancy a decade ago, this model has recently become a heavily promoted mainstream option. More than 750 libraries use SirsiDynix’s hosting services for Symphony or Horizon. As local hardware fails or reaches the end of its useful life, many libraries opt to shift to a vendor-hosted arrangement. Apart from hardware issues, some libraries move to hosting services to free their technical support staff to attend to other priorities.

The newly developed library services platforms follow more modern notions of cloud computing. Many offerings will be offered in this model exclusively, including WorldShare Management Services, Alma, and Intota. Others will have options for local installations, but we can expect that cloud deployments will dominate over time.

The product cycle

Over the next decade, we can expect at least the same level of product turnover as in the previous one. The vast majority of automation systems installed today follow the client/server approach. Just as the last decade saw a complete turnover from host-terminal products to ones based on client/server architectures, we can anticipate a similar pattern. We can also expect similar themes of “capturing the migrating customer” or “the competition heats up” (titles of the Automation Marketplace in 2002 and 2003, respectively) in the next few years, as a new wave of migrations from legacy ILS products to new library services platforms gains full steam.

Open source opportunities

Many libraries continue to opt for open source ILSs rather than proprietary products. Evergreen and Koha ILS products have become mainstream. Both offer features comparable to proprietary products and have commercial companies that offer migration, hosting, and support services. Libraries can also sponsor development for new features they require that may not be available in the software. In the United States and Canada, companies offering services include Equinox Software, the dominant firm involved with Evergreen, though it also supports a handful of libraries using Koha; ByWater Solutions, which supports Koha and is aligned with the global koha-community.org developers; and PTFS-LibLime, which offers services for two ILS products, LibLime Koha and LibLime Academic Koha. Other organizations involved in support for Evergreen include the nonprofit LYRASIS member organization; the PALS organization, associated with the Minnesota State Colleges and Universities system; and HSLC, a nonprofit supporting libraries in Pennsylvania.

In 2011, more libraries contracted for open source ILS products than in the previous year. Equinox signed 21 support contracts for Evergreen representing 117 libraries and 415 facilities, compared to 15 contracts in 2010, and another six for Koha. ByWater Solutions’ 54 contracts representing 231 libraries beat the 44 it signed in 2010. PTFS signed 22 deals for LibLime Koha representing 76 libraries, a decline from the 44 reported in 2010; PTFS also reported an additional seven contracts for LibLime Academic Koha.

The efforts of the Kuali OLE project, meanwhile, will not produce an open source ILS but a product consistent with the characteristics of the library services platform. The Kuali OLE partners are led by Indiana University, Bloomington, and include the University of Maryland, College Park; Lehigh University, Bethlehem, PA; University of Chicago; University of Pennsylvania, Philadelphia; University of Michigan, Ann Arbor; Duke University, Durham, NC; North Carolina State University, Raleigh; and a consortium of university libraries in Florida. Partial funding is provided through the Andrew W. Mellon Foundation; the Kuali Foundation manages its governance. The project anticipates completion of the initial version of the Kuali OLE software in December 2012, with implementation in partner institutions beginning in 2013. The Kuali OLE project has also engaged a commercial firm, Troy, MI–headquartered HTC Global Services, as a development partner. We can anticipate commercial firms gathering around Kuali OLE as they have open source ILS products.

Open APIs

Libraries increasingly expect to be able to access the data and functionality of their key systems through APIs, and that expectation applies to both proprietary and open source software. The availability of an open and robust set of APIs is a key characteristic of the new genre of library services platforms, and many traditional ILS products also offer this capability. SirsiDynix Symphony, for example, has included a proprietary set of APIs since 1995 (and in 2009 released its Web Services package delivering a more substantial subset of its APIs for development).

In 2011, Polaris Library Systems initiated a program called the Polaris Developer Network, in which it grants libraries using the Polaris ILS open access to its APIs, and provides a development environment and tools to help customers create and share applications. Individuals or organizations that aren’t Polaris customers can purchase membership, including companies wanting to integrate their products or services with Polaris.

Ex Libris has a long-standing practice of creating APIs for its products and making them available to its customer libraries, and that will persist with Alma. Ex Libris reports ongoing interest in its Open Platform Program, originally launched in 2008, which provides the EL Commons CodeShare for library programmers to deposit and share the applications, scripts, or other code that they create using its products’ APIs.

A fundamental precept of OCLC’s approach with its WorldShare Platform involves providing access to its APIs and cultivating a community of library developers. Just as OCLC makes use of the WorldShare Platform APIs to develop large-scale applications, libraries can build their own applications. OCLC provides an App Gallery where completed applications can be certified by OCLC and made available for use by other libraries.

Discovery Trends

Numbers represented here are as reported by the vendors; blank spaces indicate that no data was provided, or companies gave only aggregate figures.| Disovery Product | 2007 | 2008 | 2009 | 2010 | 2011 | Installed |

|---|---|---|---|---|---|---|

| Primo | 12 | 37 | 53 | 506 | 111 | 914 |

| AquaBrowser | 55 | 339 | 64 | 69 | 74 | 250 |

| Encore | 72 | 72 | 109 | 56 | 72 | 326 |

| LS2 PAC | 46 | 77 | 58 | 88 | 236 | |

| Summon | 50 | 164 | 214 | 407 | ||

| WorldCat Local | 178 | 1578 | ||||

| SirsiDynix Enterprise | 16 | 75 | 100 | 251 | ||

| Civica Sorcer | 7 | 12 | 22 | 39 | ||

| Axiell Arena | 61 | 57 | 33 | 76 | ||

| Chamo | 10 | 34 | 7 | 51 | ||

| EBSCO Discovery Service |

Intense discovery competition

Especially among academic libraries, the need for discovery tools broader than an ILS’s online catalog is well accepted. Libraries with significant investments in electronic content—which includes almost any academic library—are likely to be in the market for a discovery service if they do not already have one. Products with large indexes of scholarly content vigorously compete in this arena, including Serials Solutions’ Summon, Ex Libris’s Primo Central, OCLC’s WorldCat Local, and EBSCO Discovery Service, as well as Innovative Interfaces’ Encore Synergy, which uses web services to integrate articles into search results. Points of differentiation include the quantity of materials indexed, whether the materials are indexed by citation or full text, and the effectiveness in producing relevant results.

The providers of discovery services based on consolidated indexes compete intensely to gain access to scholarly content aiming toward the most comprehensive representation possible. NISO launched the Open Discovery Initiative in 2011 to describe best practices or standards that apply to index-based discovery services with stakeholders from libraries, content providers, and producers of discovery services.

Public libraries seek discovery products that deliver a richer end user experience and that stimulate engagement with the library’s programs and services. Many companies that offer ILS products to public libraries offer enhanced online catalog products that embody characteristics of discovery products, hoping to stem the tide of libraries seeking discovery products elsewhere.

In a remarkable move, TLC launched “Solutions That Deliver MORE,” a program that provides all its current Library.Solution customers access without cost to its new patron and staff interface products, including LS2 PAC, LS2 Kids PAC, LS2 Mobile, and the LS2 Staff Web. Between 2004 and 2008, TLC successfully promoted AquaBrowser as a next-generation catalog for its customers, and many of those installations remain. With the acquisition of that technology by Bowker (and now part of the Serials Solutions portfolio), the company developed its own LS2 PAC and has transitioned some of those customers from AquaBrowser to LS2 PAC. With LS2 PAC available to these libraries free of charge, libraries operating AquaBrowser or TLC’s legacy online catalog module are more likely to make the shift.

SirsiDynix offers Enterprise as its new-generation discovery layer and Portfolio for access to digital collections using the same platform. In 2011, SirsiDynix delivered an updated version of both products and reported 100 libraries contracting for Enterprise and 44 for Portfolio.

Taking a social media approach to discovery for public libraries, BiblioCommons continues to attract interest. Though the company did not provide sales statistics, BiblioCommons boasted many new libraries in 2011, including the New York Public Library; Vancouver Public Library, BC; and the Ohio-based CLEVNET consortium.

Expectations are rising for libraries to deliver effective discovery of library materials, along with interfaces that stimulate engagement. Combined with the large number of libraries that remain on older-generation online catalogs, this means that discovery products should continue to represent a significant portion of the industry.

Delivering through mobile devices

Interest in mobile options continues to intensify. Almost all providers of patron-facing library services offer mobile versions, but business models for access vary. SirsiDynix, for example, put out its basic BookMyne mobile app as a free download but also sells BookMyne+ to libraries if they want a customized mobile catalog. TLC, as noted, recently offered its LS2 Mobile to current customers without cost. Innovative Interfaces now provides Encore Mobile as a no-cost option for existing customers of its Encore and AirPAC. Auto-Graphics released iLib2Go in 2011, its initial mobile offering, as a free iPhone download available to all AGent VERSO sites.

Looking forward

Given the factors in play, we can anticipate moderate growth in the overall library automation economy in the next few years, with revenue enhancements associated with increased proportions of SaaS outweighing the deflationary impact of open source adoptions. Large companies with international reach, compelling products, and many customers poised to shift from local deployments to SaaS stand to make gains at a faster pace.

The lackluster sales of the last few years should begin to tick upward as libraries make commitments to new library services platforms. The turnover from legacy automation products will churn in the United States and even more intensely internationally. Expect sales of discovery products to climb; they can now be considered essential products, especially for academic libraries. As tech products become more compelling and reach sufficient levels of maturity, libraries that have deferred upgrading their infrastructure will increasingly move forward. Despite depressed budgets, libraries will continue to invest in technology products to maintain their position within their communities or parent institutions

Company Profiles

Auto-Graphics, Inc.

Pomona, CA; 800-776-6939 www.auto-graphics.com

Auto-Graphics provides library automation and resource sharing products targeting mostly public libraries. In operation since 1950, today Auto-Graphics offers the AGent VERSO ILS to public libraries, primarily as a hosted service. Since its introduction, AGent VERSO has steadily stepped upward from sales to individual smaller libraries into the ranks of larger contracts for consortia. In 2011, Auto-Graphics won a contract with the Tennessee State Library and Archives to provide AGent VERSO to a consortium of up to 100 libraries statewide. Other major contracts include the 35-member Winding Rivers Library System in Wisconsin.

Auto-Graphics reports revenue in the $5-$10 million range, with about 12 percent from libraries outside the United States. Eighty percent of revenues derive from resource sharing and other non-ILS products. The 34 personnel reported in 2011 represent an increase of two over last year, but over the last decade the company has slimmed down by ten positions.

PRODUCT NEWS The company completed development on Circulation Interlibrary Loan Link (CILL), an NCIP-compliant utility that connects the circulation functions of an integrated library system (ILS) with an external interlibrary loan (ILL) or resource sharing environment. CILL was included for the new consortium in Tennessee and has been delivered to large-scale resource sharing environments in Michigan and New Jersey.

Auto-Graphics developed a new mobile application, iLib2Go, available as a free iPhone download with the capabilities for patrons to search their library’s catalog, place holds, and renew items.

PEOPLE Executive appointments made in 2011 include Robert Brown as executive VP and Phillip DeLong as VP product development.

Axiell Group AB

Lund, – Sweden; +46 46 270 04 00 www.axiell.com

Axiell provides automation products and services to libraries, archives, and museums in the United Kingdom and Scandinavia. It does not have a significant presence in the US, but ranks as the seventh largest in the global library automation industry by total personnel. In 2011 the company changed its name from Axiell Library Group to Axiell Group, reflecting new focus beyond libraries to also include museums and archives. Axiell offers a variety of products, mostly tailored to specific countries: OpenGalaxy in the United Kingdom, BOOK-IT and LIBRA.SE in Sweden, DDElibra in Denmark, and Axiell Aurora in Finland. Axiel Calm, the company’s offering for the management of museums and archives has been implemented by over 400 institutions in Scandinavia

Recent development efforts have produced Axiel Arena, a library portal for library users that includes discovery services as well as a fully managed Web presence with capabilities for social interaction. The company signed 33 contracts for Axiell Arena in 2011 representing 78 libraries and 453 branches, with total installations now totaling 76 sites. Axiell My Library, the company’s new smartphone applications, supports both Android and iPhone.

BiblioCommons

Toronto, Ont.; 647-436-6381 www.bibliocommons.com

BiblioCommons has created the BiblioCore socially oriented discovery product designed for public libraries. The company was founded in 2007 by Beth Jefferson and Patrick Kennedy. A pure software-as-a-service (SaaS) design allows libraries to implement BiblioCommons easily. The company continues to expand the ILS products that it supports. In 2011, it developed ILS connectors for Millennium and Evergreen; SirsiDynix Symphony and Horizon were developed previously. BiblioCommons plans to complete the connector for Polaris by mid-2012.

Some of the larger public libraries that have implemented BiblioCommons include the New York Public Library, Seattle PL, Boston PL, the CLEVNET consortium, Christchurch City Libraries in New Zealand, Vancouver PL, BC, and Santa Clara PL, CA, as well as many others in North America.

PRODUCT NEWS In 2011, the company introduced BiblioCMS, providing an environment for the library to manage its entire website in addition to the online catalog replacement offered through BiblioCore. BiblioCMS has been implemented by the Yarra Plenty Regional Library in 2011, with Santa Clara PL following in 2012. The BiblioCommons mobile app launched in 2010 for the iPhone was made available to Android devices in 2011.

MondoIn (Bibliomondo)

Montréal, Canada; 514-337-3000 www.mondoin.com

MondoIn, previously known as Bibliomondo offers library automation products and services primarily to libraries in French-speaking Canada and in France. The company is privately owned by Ronald Brisebois. The company, while known to be active, has not responded to the survey since 2009.

Biblionix

Austin, TX; 877-800-5625 www.biblionix.com

One of the newer companies in the industry, Biblionix concentrates on small and mid-sized public libraries, offering its web-based Apollo only through SaaS. In 2011, an additional 79 libraries subscribed to Apollo.

PRODUCT NEWS Product developments in 2011 include integration of ebook lending through a cooperative partnership with OverDrive. Items available through OverDrive are automatically loaded into the library’s online catalog, and a simplified lending transaction takes place using secure SIP2 transactions, avoiding secondary login requirements. This feature was added to Apollo without additional fees to the libraries. Biblionix also developed a streamlined ILL workflow for libraries participating in the Texas ILL environment, working with OCLC to integrate into its Navigator platform through NCIP and automated synchronization of the library’s bibliographic and patron data.

Book Systems, Inc.

Huntsville, AL; 800-219-6571 www.booksys.com

Book Systems offers the Web-based Atriuum ILS primarily to K-12 schools and small public libraries. Sales of Atrium increased over last year with 141 contracts representing 325 libraries. Its older Concourse ILS, though it continues to be supported, has seen a steady decline in sales from a peak of 1912 in 2001 down to 146 in 2011. Since 2002, Book Systems has downsized somewhat from 88 personnel to the 60 reported this year.

Major contracts for Atriuum won in 2011 include a Huntsville City Schools in Alabama and Madison County Schools, also in Alabama, and a one-year renewal for the Memphis City Schools. The Grand Cayman Islands Public Library system implemented Atriuum, migrating from SirsiDynix Symphony.

Book Systems released new versions of both Atriuum and BookTracks in 2011. In response to increased demand for its hosted products, Book Systems has expanded its three hosting facilities it maintains in different regions of the US.

ByWater Solutions

West Haven, CT; 888-900-8944 www.bywatersolutions.com

The newest company in the industry, founded in 2009, ByWater Solutions provides services surrounding the open source Koha ILS. In the course of three years the company has seen increases in contracts won each year. The 54 contracts signed this year represent 231 libraries and 273 individual facilities. The number of libraries it supports now totals 446. While the majority of the company’s clients are public libraries, it also provides support to small numbers of academic (30), school (ten), and special (22) libraries. ByWater Solutions employs a total of 13, six of whom are librarians, which more than doubles its personnel reported in 2010.

PEOPLE This year, Nicole C. Engard, a 2007 LJ Mover & Shaker, was promoted to VP of education.

Capita

Birmingham, West Midlands United Kingdom; +44 (0)870 400 5000 www.capita-libraries.co.uk

BACKGROUND: A new name to the library automation industry, but one very well established in the customer management outsourcing arena, Capita acquired the library automation component of Talis in March 2011. A very large services firm of employing 45,000 altogether and 490 in its Software Services division, including the 43 working directly with the Alto ILS and related products acquired from Talis.

The transaction with Talis involved a spit of the company between the personnel and other assets involved with library automation and those involved with semantic Web technologies. Talis will continue to pursue opportunities for its semantic Web technologies, mostly outside the library arena, while Capita will assume responsibility for the Alto library management system and related products. The Prism 3 discovery layer, while based on the semantic Web platform retained by Talis, is also part of the Capita acquisition.

PERFORMANCE: One contract for the Alto LMS was made in 2011, bringing the total installed to 110.

Civica Pty Limited

Melbourne, Victoria Australia;+61 3 8676 4400 www.civica.com.au

The Library and Learning Division of Civica does most of its business in the United Kingdom, Australia, Asia, and supports a small number of libraries in the US. It’s workforce of 410 reflects its status as one of the largest companies in the global library automation industry. Some portion of Civica’s personnel is dedicated to its outsourcing services provided to the Ministry of Education in Singapore.

Its products include the Spydus ILS, the Sorcer library customer portal, and the Blis digital asset management system. Civica offers its products either for local installation or through hosted Managed Services.

Civica reported 46 contracts for Spydus, up from the 32 reported in 2010; 22 for the Sorcer patron portal, and 13 for Blis. Major contracts signed in 2011 for Spydus include the London Borough of Camden, joining the South East Library Consortium, the largest UK library consortium, Birmingham City Library, the Tainan City Municipal Library in Taiwan. The Ministry of Education in Singapore, encompassing 354 schools already using Spydus contracted for Sorcer and Blis.

COMPanion Corp./ Alexandria

Salt Lake City, UT;801-943-7277 www.goalexandria.com

COMPanion Corporation, founded in 1986, provides the Alexandria ILS primarily to the K-12 school library market, but with many customers also in the small public and special library sectors. This year COMPanion reported 160 new contracts for Alexandra representing 557 libraries, a decrease from the 232 signed last year. Alexandria is now used in 12,615 libraries.

Cuadra Associates, Inc.

Los Angeles, CA; 800-366-1390 www.cuadra.com

Cuadra Associates operates as a wholly owned subsidiary of SydneyPLUS, with a workforce of 18. It offers two different library automation products: STAR Knowledge Center for Libraries is based on a fully web-based environment and includes support for library materials in many different forms and media; STAR/Libraries follows the client/server model based on traditional MARC cataloging.

PRODUCT NEWS Cuadra reports that current development includes a new all web-based product with MARC support to supersede STAR/Libraries, called STAR Knowledge Center for Libraries MARC. SKCL-M, scheduled for release in early 2012, will include real-time validation of MARC subfields and indicators and support for MARC authorities and will import and export MARC records. Other developments in 2011 include the addition of a new Research Services Module to STAR/Libraries.

Cuadra did not provide detailed sales statistics for its products.

CyberTools, Inc.

Boston, MA; 800-894-9206 www.cybertoolsforlibraries.com

CyberTools, Inc. offers the CyberTools for Libraries ILS, used by many special and academic libraries. The company’s strength has traditionally been in health sciences libraries.

PRODUCT NEWS In 2011, the company released a new online catalog with streamlined functionality and an improved graphical design. A-Z lists were integrated as an easier way for users to browse for library resources. CyberTools also created a citation reference interface that allows users to send citations to RefWorks, EndNote, Reference Manager, or other citation management applications.

CyberTools did not provide a detailed response to this year’s survey.

EBSCO Publishing

Ipswich, MA; 800-653-2726 www.ebscohost.com

EBSCO, including EBSCO Publishing and EBSCO Information Services, offers a variety of products within the scope of library automation in addition to its primary business as a provider of content resources. EBSCO Information Services offers linking and electronic resource management (ERM) products including EBSCO A–Z, the LinkSource OpenURL link resolver, and ERM Essentials. The flagship of EBSCO Publishing is EBSCOhost, a platform for the delivery of hundreds of information and database products to libraries. In recent years, EBSCO Publishing has entered the discovery services arena with EBSCO Discovery Service, which integrates non-EBSCO content together with EBSCO content in a unified Index. Its federated search tool (EBSCOhost Integrated Search) provides a complementary optional means within the EDS experience for pulling in resources that are not available via discovery services. The company also offers OPAC on EBSCOhost for public libraries to leverage the EBSCOhost platform as the front end for their catalog.

PRODUCT NEWS The products of EBSCO Information Services and EBSCO Publishing operate on separate technology platforms. EBSCO Publishing debuted a unified platform that integrated the former NetLibrary ebook collection with EBSCOhost. The company also acquired H.W. Wilson Co. In early 2012, EBSCO announced that the span of products would converge on the EBSCOhost platform, giving EDS native integration with A–Z and LinkSource. (See also Innovative Interfaces profile.)

EBSCO did not report specific sales statistics for its products. Some of the announced sales of EDS include Bielefeld University in Germany, the National Library of France, Özye University in Turkey, University of Cumbria in the UK, Asbury Theological Seminary, University of Maryland–College Park, Okanagan College in British Columbia, Nanyang Technological University in Singapore, University of North Carolina–Charlotte, Korea University, Middle East Technical University, National University (CA), and Universität für Musik in Austria. This list reveals that EDS has been adopted by a wide range of libraries worldwide, mostly in the academic sector.

EOS International

Carlsbad, CA; 800-876-5484 www.eosintl.com

EOS International, well established in the special library arena, continues to expand the libraries to which it markets its EOS.Web ILS. The company’s traditional strength lies in the legal library arena; 34 percent of the top 250 U.S. law firms use its products. EOS reports a positive response to its EOS.Web Academic in 2011, primarily among smaller educational institutions or special libraries within large universities. EOS.Web Digital provides support for both digital and print materials including features for ERM and digital asset management and for storing digital content.

In 2011, there were 91 new contracts for EOS.Web, down slightly from the 97 reported last year.

The company employs 52, with no change from 2010.

Equinox Software

Duluth, GA; 877-673-6457 www.esilibrary.com

Equinox Software, founded in 2007, provides services surrounding the open source Evergreen ILS. Equinox has been involved with Evergreen from its beginning and continues as the dominant company behind its development and support. The company also provides services for Koha, though this represents a small portion of its business. Equinox holds service contracts with 450 libraries for Evergreen and only 17 for Koha. Consortia comprise most of Equinox’s customers.

Evergreen development takes place through a broad-based community, though Evergreen ultimately performs the largest portion of work through sponsored projects and its own initiatives. Version 2.1 was completed in 2011.

In fall 2011, Evergreen passed the threshold of over 1000 libraries in production. Not all of these libraries rely on support from Equinox; a few other firms now also provide support, and some libraries have implemented Evergreen on their own. Evergreen is also beginning to spread internationally.

Equinox Software moved into a new HQ building in Duluth, GA, to house its operations. The company currently employs 21, down from 28 in 2009. The number of contracts signed for Evergreen has increased every year since 2008. Early in 2012, the company announced the opening of a subsidiary, Equinox Library Services Canada.

Ex Libris Group

Jerusalem, Israel; 972-2-6499100 www.exlibrisgroup.com

Ex Libris specializes in library automation products and services for academic and research libraries. With a vast arsenal, it has a presence in over 5000 institutions in 81 countries.

The company has grown organically by attracting libraries to the products it created and through business acquisition. In 2006, private equity firm Francisco Partners acquired Ex Libris and Endeavor, creating a consolidated company, with two key ILS products, Aleph and Voyager. In 2008, ownership shifted to Leeds Equity Partners. Ex Libris has seen phenomenal growth over the last decade, increasing in personnel from 206 in 2002 to the 512 reported for 2011. In that same period the number of libraries using Aleph has grown from 700 to 2,316.

PRODUCT NEWS The company has maintained an emphasis on research and development and has a track record of creating new products, often establishing new product genres. The 170 personnel Ex Libris allocates to development almost doubles any competitor. Ex Libris created the first commercial OpenURL link resolver, based on technology acquired from the University of Ghent in 2000. More recently it created the bX recommendation service, which finds related articles based on associations mined from link resolver logs. Culminating in the Rosetta product in 2009, Ex Libris partnered with the National Library of New Zealand to create the first commercial digital preservation platform for libraries. Ex Libris launched the Primo discovery product in 2006 and the development of the Primo Central Web-scale index in early 2009. A recent development project created ScholarRank, a technology based on a new algorithm and factors for calculating relevancy rankings of search results in Primo.

Ex Libris has expanded the number of libraries eligible to access the Primo technology through its MetaLib+ product. Libraries that have previously licensed MetaLib can use a customized Primo interface to access the Primo Central index in addition to targets configured through MetaLib. About 200 libraries have elected to implement MetaLib+.

As noted in the overview, Ex Libris has focused many of its resources on completing Alma, with incremental releases to development partners in 2011 and general release planned in mid-2012.

Parallel to development of Alma, Ex Libris continues to enhance and support its existing products. Voyager Version 8, released in July 2011, includes a variety of functional improvements. The commitment that Ex Libris made to develop and support Voyager seems to be reflected in the slight growth of installed sites from 1,175 in 2006 to 1,255 this year. Aleph Version 21 was delivered in early 2012.

The National Diet Library of Japan completed its installation of Aleph in 2011, representing the largest and most complex installation of Aleph to date, managing the library’s 20 million bibliographic records and consolidating other major indexes and catalogs. Oxford University in the UK also placed its Aleph system into production in 2011.

Follet Software Company

McHenry, Illinois; 815-344-8700 www.follettsoftware.com

Follett Software Company ranks as a major provider of automation for K-12 school libraries, but has steadily expanded its scope to address a broader array of management tools for schools beyond the libraries. Follett Software Company is a division of Follett Corporation, a much larger entity with annual sales of $2.7 billion.

Organizational changes transpired in the last year following the June 2010 appointment of Chuck Follett, formerly head of the company’s Technology Solutions and International Group as CEO of the entire company. As of November 2011 long time FSC exec Tom Schenck advanced to role of President and CEO of the newly formed Follett Scholl and Library Group, including Follett Educational Services, Follett Library Resources, BWI, Follett Software Company and Follett International. Prior to this promotion Schenck’s portfolio included Follett Technology Solutions and Follett International; from 1998 he was President of Follett Software Company. Simona Rollinson, previously VP Services and Operations, was named President of Follett Software Company in the spring of 2011. According the Financial Times (July 14, 2011) all or part of Follett Corporation may be for sale and has retained Credit Suisse to advise and assist.

Follett reported a workforce of 365, a significant drop of 43 from the 408 employed in 2010. The company noted that part of this reduction was related to acquisition of the X2 Development Corporation and the elimination of roles duplicated within the organization.

Development accomplishments in 2011 include the release of Destiny 10.0, a major upgrade to the company’s flagship technology platform for schools and districts. This release includes the availability of the Destiny Quest mobile app that offers catalog search and other features to smartphones and tablets. The Destiny product family includes Destiny Library Manager, Destiny Textbook Manager, and Destiny Asset Manager. For 2011, Follett reported total installation of Destiny Library Manager for Districts of 44,318 with another 4,173 using Destiny Library Manager for Schools. In May 2011 Follett announced the Textbook and Device Management Package that combines the functionality of the Destiny Manager for Textbooks and Destiny Asset Manager to handle the increasing scenarios of electronic textbooks delivered through tablets or other devices.

Following the Oct 2010 acquisition of X2 Development Corporation, Follett has also been very active in the development, marketing and support of the Aspen student information system. New contracts for Aspen in 2011 included the Boston Public Schools.

Infor Library & Information Solutions

Framingham, MA; 800-825-2574 www.vubis-smart.com

Infor operates as a relatively small division of a very large IT services company. Tracing its roots to Geac, one of the pioneering companies of the library automation industry, today Infor does most of its business in Europe, with a smaller presence in Canada and the United States. The company’s flagship ILS has evolved over the years through multiple cycles of technology. Today, the company focuses development and sales on V-smart, though Vubis Smart continues to be supported and enhanced.

PRODUCT NEWS This year, Infor also delivered Iguana Version 2.0, the latest version of the company’s library discovery and portal interface, which provides a complete replacement for both the library’s online catalog and website. In 2011, Infor reported 12 new contracts for Iguana, including the Vatican Library.

Major contracts for V-smart in 2011 include the Canadian National Institute for the Blind and Bibliothèques communautaires Strasbourg in France.

This year, Infor launched V@school, a service for school libraries in The Netherlands based on V-smart and Iguana.

Infovision Software, Inc.

San Diego, CA; 800-849-1655 www.infovisionsoftware.com

Infovision offers Evolve Library, an ILS primarily oriented to public, school, and special libraries. The company had previously been involved with the Amlib ILS as a distributor of InfoVision Technology based in Australia, but following that company’s 2008 acquisition by OCLC, Infovision began the development of Evolve Library, which was launched in 2010. The company has also developed Evolve Electronic Documents and Records Management and Evolve Planning for city and county governments.

For the last two years, Infovision has been working toward transitioning its customer sites from Amlib to Evolve. This year, Infovision signed 19 contracts representing 100 libraries for Evolve.

Inmagic

Woburn, MA; 800-229-8398 www.inmagic.com

Inmagic offers library automation and knowledge management products, primarily in the special library arena, including the DB/Text Library Suite, Inmagic Genie, and Inmagic Presto. In 2011, Inmagic went through a significant transformation as it divided itself between products for the library automation arena and technologies that could be exploited in other industries. SydneyPLUS acquired the Inmagic brand, including its DB/Text Library Suite, and will continue to offer Presto for Social Libraries.

Inmagic did not respond to this year’s survey.

Innovative Interfaces, Inc.

Emeryville, CA; 510-655-6200 www.iii.com

Innovative stands as the fourth largest of the North American library automation companies in terms of personnel employed (311), third largest in revenue, and third in libraries served (1,425). Thirty percent of revenues, reported in the range of $80-$90 million, comes from libraries outside the United States. In March 2012, Innovative announced that two private equity firms had invested in the company (see p. 18ff.).

PRODUCT NEWS In April 2011, Innovative made its initial announcement that it would develop a new-generation automation platform called Sierra. Taking forward the functionality of its Millennium ILS, Sierra embraces a new technical architecture, a more open design exposing a service layer of APIs for all aspects of functionality, and a new suite of applications. Unlike Millennium, which offered separate modules for each functional area, Sierra follows a more unified approach delivering all staff tasks through a single client. Sierra will make use of the open source components such as PostgreSQL for data storage and transactions and Apache Lucene for search and retrieval. Millennium gained a reputation as a relatively closed system.

Innovative began initial testing of Sierra late in 2011 and plans to deliver the first production version in 2012.

Sierra has generated remarkable interest in libraries, with 206 organizations signing contracts, representing 700 libraries and spanning 1,615 individual branches, a number of sales almost unprecedented in this sector of the industry. This initial tsunami of contracts emanates primarily from libraries using Millennium, with only one coming from a competing ILS.

Contrary to any perceptions that Innovative may be losing ground, this opening turnout for Sierra reflects strong confidence by the company’s customers in its future direction. In recent years, Innovative has lost customers migrating to open source ILS products; however, its customer base has grown, with new sales outpacing defections. Going forward, it will be interesting to see whether the more open and comprehensive Sierra system will stem the leakage.

Innovative continues to enhance Millennium even as it develops its ultimate replacement. Enhancements in the Millennium Release 2011 include new features in most of the functional modules as well as in its SMS Alerts, Express Lane self-check software, and Circa wireless inventory utility.

Encore 4.1, the latest version of the company’s discovery layer delivered in 2011, was enhanced to include an advanced search feature to provide multiple query options in addition to the single search box of earlier versions. Through a partnership with EBSCO, Encore can now integrate search results from EBSCO Discovery Service, allowing libraries that subscribe to that product to view results through the Encore interface.

Innovative released Content Pro 2.1, updating its digital asset management system with a new interface, support for live video streaming, and a new carousel feature that allows presentation of image slide shows either through the product’s own interface or embedded in external environments.

A new product, Decision Center, announced for late 2012, will provide a variety of tools to help libraries more efficiently shape their collections and operations based on dynamic data from multiple areas of their automation environment. Decision Center will make recommendations of areas to focus acquisitions or weeding, help establish budget allocations, and set optimal hours of staffing.

Innovative expanded its InnoU training program, offering workshops in other regions beyond those already available at its HQ facility. A new program allows individuals completing specific classes and workshops to be certified as a Millennium Technical Services Coordinator or as a Millennium Systems Coordinator.

PEOPLE With Neil Block in place as president since August 2010, Innovative made additional executive appointments this year, including Hillary Newman as senior VP of product development and John McCullough as VP of product development.

Keystone Systems, Inc.

Raleigh, NC; 919-782-1143 www.klas.com

Keystone Systems, a veteran company of 30 years, offers KLAS, which is used primarily by libraries that serve persons with visual disabilities. The company continues as the leading automation provider within this very specialized niche, though there were no new sales reported in 2011.

One of the major activities of the company involves the Shared Electronic Files (SHELF) project to provide a national repository of materials produced by participating libraries. This SHELF project, begun in 2010 as a pilot, was placed into full production in 2011. Nine new libraries joined SHELF in 2011.

Ongoing developments in the company’s flagship KLAS environment include enhancing its ability to integrate with external systems. This capability supports the SHELF project as well as libraries that make use of RFID automated sorting systems.

The Library Corporation

Inwood, WV; 304-229-0100 www.TLCdelivers.com

The Library Corporation (TLC) offers two main lines of ILS products, including Library.Solution for small through medium-large libraries, and Carl.X for large consortia and municipal systems. In 2011, TLC signed two new contracts for Carl.X representing 51 libraries, both migrating from Carl.Solution, and 48 for Library.Solution covering 153 libraries.

PRODUCT NEWS In recent years, TLC has focused much of its development efforts on enhancing its interfaces and creating new end user products. At its October 2011 user conference, the company announced that customers current on their ILS products would receive without cost the LS2 PAC, Kids PAC, LS2 Mobile, and LS2 Staff Web, allowing them to step up freely into the company’s new-generation products.

TLC reports that it employs 199, unchanged from last year.

LibraryWorld, Inc.

San Jose, CA; 800-852-2777 www.libraryworld.com

LibraryWorld offers a fully Web-based library automation service of the same name, primarily to small libraries.

In 2011 the company released LibraryWorld 3.0, which included a newly designed user interface with improved navigation and new social media sharing features. The company reported subscriptions representing 2,478 libraries in 2011.

Mandarin Library Automation, Inc.

Boca Raton, FL; 800-426-7477 www.mlasolutions.com

Mandarin Library Automation works primarily with school and small public libraries but also with academic and special libraries. This year the company saw strong interest in its hosted option for its flagship Oasis ILS, with 58 new contracts compared to 35 for the traditional version; another 90 sales were made for the Mandarin M3 ILS.

PRODUCT NEWS In October 2011, Mandarin launched its new Mandarin CMS, a hosted service that provides a complete customizable web presence for a library, fully integrated with the web OPAC of its ILS products. CMS provides all the administrative tools to manage both the website and the online catalog and will include the ability to promote the library’s content and programs through reading lists, library events, an art gallery, live video streaming, RSS feeds, a newsstand, and other features.

Also in 2011, Mandarin entered a partnership with Jennifer Nelson LLC to represent its products to schools worldwide.

OCLC

Dublin, OH; 614-764-6000 www.oclc.org

OCLC continues to have an increasing presence in the library automation industry. Through its business acquisitions, it supports a set of legacy products across many international regions. In 2011, OCLC expanded its acquisitions also to include the Bibliotheca2000 and Bibliotheca.Net products of the German BOND GmbH.

PRODUCT NEWS Previously announced as Web-scale Management Services, the WorldShare brand was initiated in 2011. The WorldShare Platform provides the general technology infrastructure that supports the WorldShare Management Services (WMS) product and the recently announced WorldShare License Manager. The WorldShare Platform will also support applications created by libraries and other organizations. OCLC indicates that it plans to expand its applications offered through the WorldShare Platform to include resource sharing, metadata management, and consortial borrowing. The WorldCat name will persist for end user–facing services such as WorldCat.org and WorldCat Local.

By the end of 2011, OCLC reported that 38 libraries use WMS in production and a total of 184 have signed contracts for implementation. This year the University of Delaware became the first Association of Research Libraries (ARL) member to commit to WMS.

As a global membership organization, only a portion of OCLC’s activities fall within the scope of the library automation industry. This year we calculated that of the organization’s $205 million revenues, around $58 million derive from products and services that compete with other companies in this industry.

Polaris Library Systems

Syracuse, NY; 800-272-3414 www.polarislibrary.com

Polaris Library Systems continues to expand its market share among public libraries in the United States and Canada, as well as a growing contingent of academic libraries. In 2011, Polaris won an additional 50 contracts representing 285 libraries.

PRODUCT NEWS 2011 saw significant development toward a major upgrade of Polaris. Polaris 4.1, scheduled for release in early 2012, will feature significant redesign, including a new Polaris Discovery Suite that will provide a single search box addressing both traditional physical materials owned by the library and the electronic materials to which it subscribes. This release will also incorporate new modules called Feature IT and Community Profiles that highlight content and resources provided by local organizations.

As part of its customer support efforts to provide consistent service, Polaris reports that 74 percent of its sites have implemented the latest version of Polaris.