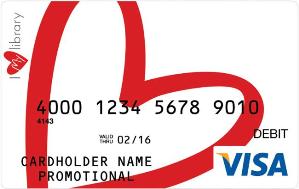

Following four months of discussions with SirsiDynix and a brief pilot test this summer, Maryland’s Frederick County Public Libraries (FCPL) on September 5 officially launched the “I Love My Library” prepaid Visa debit card. Developed by SirsiDynix in partnership with Visa and Card Limited, the new affinity cards double as a patron’s library card and aim to help libraries achieve three goals:

Following four months of discussions with SirsiDynix and a brief pilot test this summer, Maryland’s Frederick County Public Libraries (FCPL) on September 5 officially launched the “I Love My Library” prepaid Visa debit card. Developed by SirsiDynix in partnership with Visa and Card Limited, the new affinity cards double as a patron’s library card and aim to help libraries achieve three goals:

- Offer “unbanked” patrons access to a debit card with a transparent fee structure as a component of a library’s financial literacy programming.

- Develop deeper ties with local businesses through a Linkable Networks feature that will enable local and national merchants and restaurant owners to partner with libraries and offer discounts to card holders.

- Provide a new revenue stream to libraries, which will receive a small donation from Card Limited each time a card is activated—one dollar in FCPL’s case—as well as seven percent of each card’s monthly fee, a portion of transaction fees, and typically one percent to two percent of each affinity card transaction from merchants that partner with the library through the Linkable Networks feature. These fees cannot be waived by the library if a patron opts to register the card with Visa. However, if a patron chooses not to register the card, it will still work at the library.

Some librarians may find the concept of offering a prepaid card as a revenue stream unusual or possibly in opposition to the non-profit tradition of public libraries, acknowledged Eric Keith, VP of global marketing, communications, and strategic alliances for SirsiDynix. However, there is a real need for these services among many demographics that are heavy library users. Libraries, unlike convenience stores or other retail outlets that sell prepaid debit cards, have the opportunity to tie these cards into financial literacy programs, Keith noted. And, where many prepaid cards have an average lifespan of six months, according to a 2012 study by the Federal Reserve Bank of Philadelphia, users are much more likely to retain a dual-use card, thus avoiding a new cycle of activation and other fees when obtaining a new prepaid card.

Unbanked patrons

In its most recent National Survey of Unbanked and Underbanked Households, published in September 2012, the Federal Deposit Insurance Corporation (FDIC) found that 8.2 percent of U.S. households—or one in 12—are unbanked, meaning that no one in a given household had access to a traditional checking or savings account. An additional 20.1 percent of U.S. households are “underbanked,” meaning that they have access to a bank account, but have also had to rely on alternative financial services (AFS) such as money orders, check-cashing services, payday loans, rent-to-own services, pawn shops, or refund anticipation loans during the past twelve months.

AFS tend to have significantly higher fees and interest rates than traditional banking products. According to estimates from the Center for Financial Services Innovation, a nonprofit financial services consultancy, the unbanked and underbanked spent $89 billion in fees and interest using AFS in 2012.

“There’s a large cash-only population out there,” FCPL Director Darrell Batson told LJ. FCPL is participating in a local financial literacy council sponsored by the United Way, and has hosted financial literacy programs to help patrons sign up for savings accounts, for example. Batson said that he does view this prepaid card as having the potential to provide a bridge toward improved financial stability for some patrons, if libraries can successfully link it to broader educational efforts.

“If we can get [unbanked patrons] interacting with financial institutions, or establishing credit, or actually securing their finances in a more mainstream way, they’re not so liable to be prey to check cashing schemes and [payday loans],” Batson said. “If they’re out of that, then they really do have the resources to improve their lives.”

There is significant demand for financial services for people who do not want or cannot obtain a standard bank account. In its 2013 study “Prepaid Cards: How They Rate” Consumer Reports estimated that $167 billion would be loaded onto prepaid cards alone in 2014. Yet many of these services charge fees or interest rates that are significantly higher than those charged by banks. Consumer Reports, for example, singled out one prepaid card with an activation fee of $19.95, which also charges users up to $4.95 to load money on to their card, and $2.00 each time they call customer service.

This is an extreme example. In comparison with the cards analyzed by Consumer Reports, the I Love My Library card’s one-time activation fee of $5.95 and ongoing maintenance fees of $5.95 per month are in the middle of the pack. However, Justin Swain, end user services consultant for SirsiDynix, noted that SirsiDynix had specifically worked to avoid hidden fees and to make this card’s fees as transparent as possible.

This is an extreme example. In comparison with the cards analyzed by Consumer Reports, the I Love My Library card’s one-time activation fee of $5.95 and ongoing maintenance fees of $5.95 per month are in the middle of the pack. However, Justin Swain, end user services consultant for SirsiDynix, noted that SirsiDynix had specifically worked to avoid hidden fees and to make this card’s fees as transparent as possible.

For example, unlike many other prepaid options, users are not charged fees to load money onto their cards via direct deposit or electronic transfer (although many retailers will assess their own fees if users want to load cash onto a card). Customer service calls, online card account access, electronic bill and check payments, and text and email alert features are all free. There are no overdraft features, so there are no overdraft penalties or fees. If a card goes unused for 45 days, monthly maintenance charges will cease, and will resume only when the card is used again or reloaded with funds, without incurring a separate re-activation fee. And while there is a $2.50 charge for using ATMs and a $1.95 charge for each PIN-based transaction (including cash back at retailers), there are no fees for signature-based transactions.

In addition, financial information is never shared with the library, and the library never shares patron information with Visa. Lost or stolen cards are protected by Visa’s Zero Liability policy.

“We worked for a solid year to put together a program where the fees are at the lower end of the [prepaid card market] scale,” Keith said. “We’ve got low activation fees, low monthly fees, and low transactional fees.”

Beta Feedback Leads to Changes

SirsiDynix publically announced the new affinity card as the BLUEcloud Library Visa Prepaid Card at the annual COSUGI user group meeting in May, as a component of its Community Funded Services revenue stream platform. In addition to FCPL, Lansing Public Library in Illinois was part of the earliest discussions with SirsiDynix about the new product, and two other systems in Florida and Mississippi began testing the new cards this summer. The cards will be available to all interested SirsiDynix libraries in Q4.

“When we heard about the concept, we thought it had some possibility…. But we were apprehensive,” said Batson. One issue was the BLUEcloud branding. While familiar to librarians who are current SirsiDynix customers, the BLUEcloud brand wouldn’t have any significance for patrons. And, while FCPL did its own research and found the proposed fee structure of the cards to be competitive and fair, Batson didn’t think that the library affinity program alone could compete against other prepaid cards in a crowded market.

“My point to them was, ‘what’s your hook?’” Batson said. “There are thousands of cards out there…. To their credit, they took a core of an idea, and polished it.”

Partnering with local business

Frederick’s Central Library is in the center of a vibrant downtown historic district and adjoins this lovely riverwalk

In addition to the new name and new look, Batson was enthusiastic about partnering with local businesses via Linkable Networks, another feature that was added after the initial discussions. A short walk outside of FCPL’s central C. Burr Artz Public Library quickly explains why. The library is located in a large and vibrant downtown historic district with hundreds of locally-owned businesses. On launch day, FCPL also kicked off its annual outdoor concert series, Music on the Terrace, with afro-pop band Elikeh jamming as locals dined at cafes, pubs, and sandwich shops lining the riverwalk behind the library. Restaurant staff handed out event-only coupons alongside an I Love My Library card display.

FCPL is already engaged with Frederick’s business community, and Batson hopes the card will help strengthen those relationships. He has already discussed potential partnerships with the Frederick County Chamber of Commerce, which has expressed enthusiasm about the possibilities as well. Batson and Swain separately noted that reaching a critical mass of such partnerships will help broaden the appeal of the card for patrons who do have bank accounts, but will view the card as a way to support their library and support local businesses.

“It’s not by happenstance that downtown [Frederick] is vibrant. The community as a whole works for that,” he said. “When we talked to SirsiDynix and we talked to the Chamber of Commerce, we said ‘we agree with this [Linkable Networks] product, but the first place we’re going to is our local businesses. We’re not going to Wal-Mart and we’re not going to Target. We’re doing family, we’re doing our companies downtown’… That’s how we’ll be [explaining] it to our patrons.”

The launch of the new prepaid card coincided with the beginning of FCPL’s annual Music on the Terrace outdoor concert series

Card Limited will be working to bring national retailers and chain restaurants on board with I Love My Library card discount partnerships. Based on the library system that their card is affiliated with, patrons will be able to view a list of “linkables” deals available to them on the ilovemylibrarycard.com site, whether that business is a local sandwich shop or a national pharmacy chain.

Asked whether the library’s tapping a new revenue stream dependent on commercial activity might set an unfortunate precedent, perhaps even threatening municipal funding down the road, Batson said, “well, you’d honestly have to show me libraries that have experienced massive increases in their municipal budgets during the last ten years.”

Later, he circled back to the card’s potential to enhance FCPL’s ties to local businesses and the local community.

“A lot of things are mandated by law—fire departments, police,” Batson said. “Libraries aren’t mandated by law. There’s no law we can point to that says ‘you have to fund us, you have to maintain us.’ Libraries are here because communities insist on us and believe in us. If we don’t continue to build that credibility and interaction, we won’t be here.”

This service strikes me as fraught with ethical dangers. If financial literacy is a primary goal shouldn’t we be pointing patrons to high-quality consumer resources to evaluate products like this? Consumer Report’s top-rated “Bluebird” card, for example, appears to be much less expensive than the SirsiDynix card — no monthly maintenance fee, no activation fee and no charge for PIN-based transactions. The S/D BlueCloud’s $120/yr maintenance fee alone comes to a whopping 24%APR based on a $500 average balance without adding in ATM and cash load fees ($4-$5 according to CR). So what do you say to patrons when they ask if the Library’s card is a good deal?

Hi Chris,

Thanks for commenting. I agree that libraries will need to discuss these concerns. As mentioned in the story, the I Love My Library card does not charge fees for loading money onto the card via direct deposit or electronic transfer. It also does not charge cash load fees, although most retailers that offer those services will assess their own fees for cash loading.

As you mention, the card’s $5.95 monthly maintenance fee is not the lowest available (readers interested in comparisons can check out the link to the Consumer Reports “Prepaid Cards: How They Rate” story above. Note that the report was published in 2013 and does not include this card), but it’s the only fee charged by the card other than ATM fees and PIN transactions, and in my opinion, it is comparable to the monthly fees that most commercial banks now charge for low balance checking accounts.On an annualized basis, these maintenance charges would be closer to $72 than $120.

I also agree that with any financial literacy program that included info on prepaid cards, a librarian would probably want to explain a range of options to patrons, as well as ways to minimize fees by choosing signed transactions rather than PIN transactions, for example.

I agree completely with Chris.

If the goal is to help people become more financially literate and stable, helping them get a simple no-fee bank account and debit card is what libraries should be doing. I think it’s unconscionable for libraries to be making any money at all by pitching these products to “unbanked” patrons. Any money paid to the libraries is being added to the fees that these patrons have to pay and it’s inappropriate for us to have an income stream that relies on surcharges and other historically notoriously predatory practices such as these.

Let me see if I understand this: The “unbanked” are vulnerable to being overcharged due to their reliance on alternative financial services like check-cashing services, payday loans, and prepaid cards with high fees. The library claims to be addressing this problem by…marketing prepaid cards with high fees. (Desperate attempt at rationalization: these fees are “at the lower end of the scale” compared with many other cards!)

Credibility is the library’s raison d’être and most precious asset. What a shame to see libraries selling it off, and so cheaply too.

How many of the folks who this card is marketed to can get the card but can’t get a bank or a credit union account? There are some folks who can get a regular bank account– ID requirements for banks are more stringent than those for library cards, for instance– but it looks like there are also ID requirements for the debit feature beyond those required for the library card; see the “What are the requirements for the new card?” section of

http://www.fcpl.org/library-services/i-love-my-library-visa-prepaid-cards

Where the only barrier is what the article calls “financial literacy”, shouldn’t the library be telling patrons about free banking options rather than steering them to a debit card that keeps feeding on their balance as they use it?

I did a quick search online for credit unions in Frederick County and the first one I pulled up (nymeo.org) offers free no-minimum-balance checking accounts with free debit cards for anyone who lives, works, or does other business in Frederick County, and can satisfy the ID requirements. There are charges for overdrafts, out-of-network ATM use, prolonged inactivity, early closing, and some out-of-the-ordinary services, but no fees that I could see for normal everyday use. As long as you’re careful not to overdraw, and meet the eligibility requirements, it seems a much better deal than the card the library’s marketing.

Librarians could easily find the same information I did. Are they, and are they letting their patrons know about these alternatives, in Frederick County?

You all have covered the ethics of this very well. So, as someone who coined the phrase “I value my library and I vote” ™, my first reaction was argh!, Libraries need to stop being needy. We don’t need to be loved. We need to be valued and IMHO, this gimmick isn’t going to do it.